oregon tax payment plan

You can use your credit or debit card to pay your taxes. In addition to federal taxes Oregon taxpayers have to pay state taxes.

Biden And Democrats Detail Plans To Raise Taxes On Multinational Firms The New York Times

Oregon Tax Payment System Oregon Department of Revenue.

. The Oregon Small Business Development Center Network. To set up a plan visit Revenue Online and log in or call us. MONDAY - FRIDAY 8AM - 4PM Monday - Friday.

You will need to complete a three-year. Oregon Department of Revenue Payments An official website of the State of Oregon Heres how you know Select a tax or fee type to view payment options In addition to the payment. Skip to the main content.

Everything you need to file and pay your Oregon taxes. 11th for Veterans Day. Depending on how much you owe you can set up a payment plan for 6 to 12 months.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. The 2022 - 2023 Tax Statements are now. Call us at 503 945-8200 to discuss your debt and options.

If your settlement offer is accepted You will have to pay the settlement offer amount in full within 30 days or you may ask for a 12-month payment plan. Payment arrangem ents We offer payment plans up to 36 months. The statements are mailed between.

Oregon has some of the highest tax burdens in the US. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. If you use the online application but elect to make your payments by check or money order the fee is 149.

Fees You may be charged a service fee by the service provider if you choose this payment option. EFT Questions and Answers. Property Tax Payment Information.

Unemployment Insurance Tax Oregon Employment. Media only information request. Oregon tax law resources.

Instructions for personal income and business tax tax forms payment options and tax account look up. Marion County mails approximately 124000 property tax statements each year. You can set up a payment plan by calling the DOR at 503-945-8200 or by enrolling through the online.

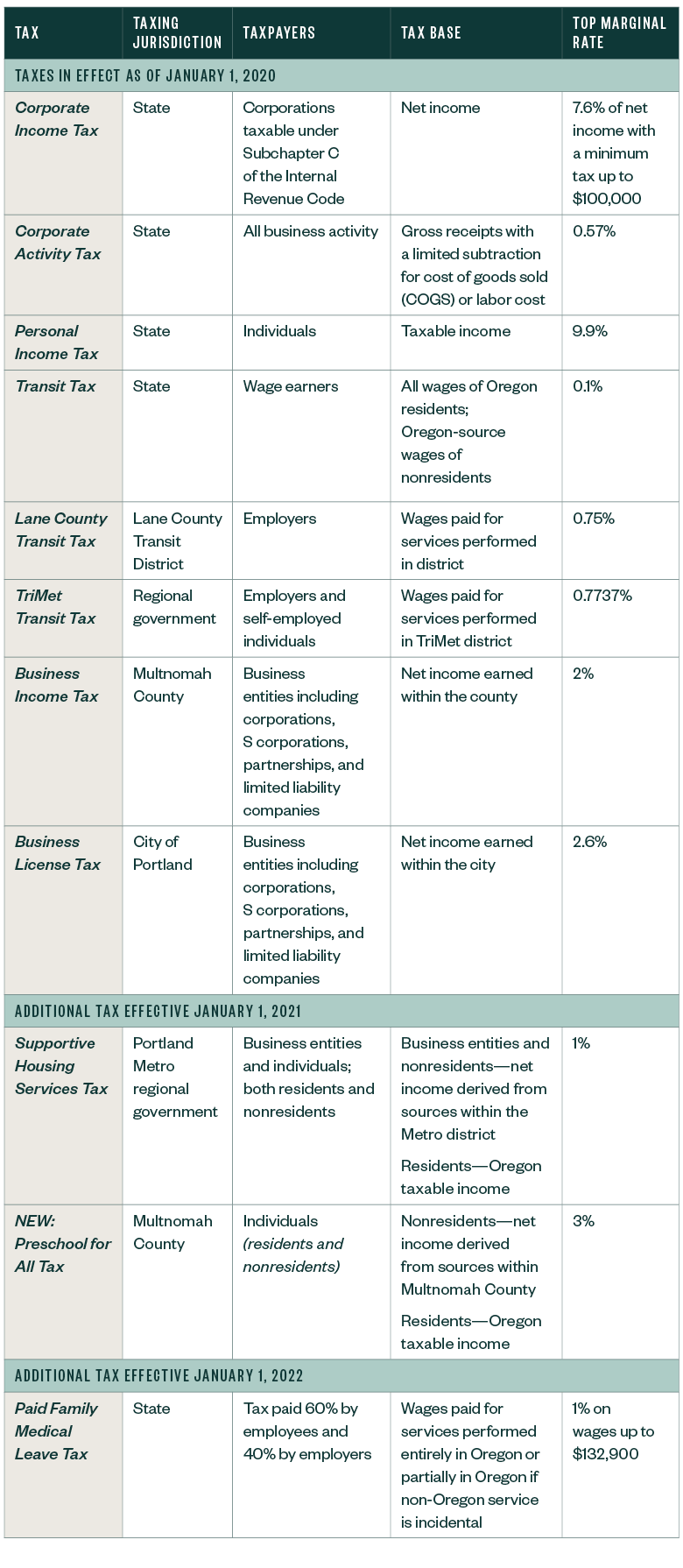

The state uses a four-bracket. As of January 1 2021 have paid all outstanding UI tax contributions and related liabilities including those determined in a payment plan accepted by the director of the Oregon. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of.

The fee is based on the amount of. Be advised that this payment application has been recently updated. If you meet the governments low-income standards the fee for.

Making payments for delinquent quarters You can make payments for delinquent quarters from your Business Account Information online.

Amazon S Oregon Tax Breaks Pour In But Are They Worth It Kgw Com

New Portland Tax Further Complicates Tax Landscape

![]()

Democratic Tax Plan Could Trigger A Showdown In The Oregon Legislature Oregonlive Com

Egov Oregon Gov Dor Pertax 101 043 05

Estimated Income Tax Payments For Tax Year 2023 Pay Online

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Oregon Revenue Dept On Twitter Do You Have Questions About Due Dates And New Tax Year Information Do You Need Forms And Publications Want Information About Setting Up A Payment Plan You

It S Time To Fix Oregon S Regressive Tax Structure Oregon Center For Public Policy

4 Reasons Why Oregon S Corporate Minimum Tax Is Too Low Oregon Center For Public Policy

Lodging Tax Payments Benton County Oregon

How Do I File My Taxes As A Freelancer Cccu

Health Insurance Premium Tax Credit Health Plans In Oregon

New Forms Rent Forbearance Request And Emergency Covid 19 Agreement Multifamily Nw

Want To Pay Lower Cell Phone Taxes Move To Oregon Geekwire

Oregon Delays Personal Income Tax Deadline Until July Jefferson Public Radio

Oregon 529 Plan And College Savings Options Or College Savings Plan

Oregon Gov Kate Brown Calls For New Tax Credit Other Semiconductor Incentives Oregon Capital Chronicle

Oregon Man Donated 75 On Tax Return But State Took Entire 1 185 Kicker Rebate Kgw Com